Key Trends in Data Analytics and Financial Reporting for Business Intelligence

Key trends in data analytics and financial reporting for business intelligence have evolved dramatically in recent years, transforming how organizations make strategic decisions. As businesses face increasingly complex data environments, integrating advanced analytics with financial reporting has become essential to gaining actionable insights. This shift is driven by innovations in technology, from artificial intelligence and machine learning to automation and cloud computing, which enable faster, more accurate analysis of financial and operational data. In this article, we will explore the emerging trends shaping data analytics and financial reporting within business intelligence, highlighting how these advancements improve accuracy, enhance forecasting, and support dynamic decision-making processes.

Integration of AI and machine learning in financial analytics

Artificial intelligence (AI) and machine learning (ML) are revolutionizing data analytics by enabling systems to identify patterns, predict trends, and automate routine tasks with minimal human intervention. In financial reporting, AI-powered tools can detect anomalies, flag potential risks, and provide deeper insights into financial performance. For example, ML algorithms allow continuous learning from historical data, improving forecast accuracy over time. This integration not only reduces errors and operational costs but also expands the scope of analytics beyond static reports to dynamic models that adapt to changing market conditions.

Moreover, AI-driven natural language processing (NLP) aids in automating narrative reporting, turning complex financial data into easily understandable summaries for stakeholders. These capabilities enhance transparency and facilitate quicker decision-making across departments.

Emphasis on real-time data and predictive analytics

The demand for real-time data processing has reshaped financial reporting, shifting organizations away from periodic reports toward continuous, up-to-the-minute insights. Real-time data analytics help finance teams respond swiftly to market fluctuations, compliance issues, or operational disruptions by providing instant visibility into key financial metrics.

Complementing this is the rise of predictive analytics, which uses historical and current data to forecast future financial outcomes with higher confidence levels. Businesses leverage predictive models to anticipate cash flow trends, optimize budgeting, and mitigate risks before they occur. This proactive approach transforms traditional business intelligence into a forward-looking strategy that drives growth and resilience.

Automation and enhanced data visualization

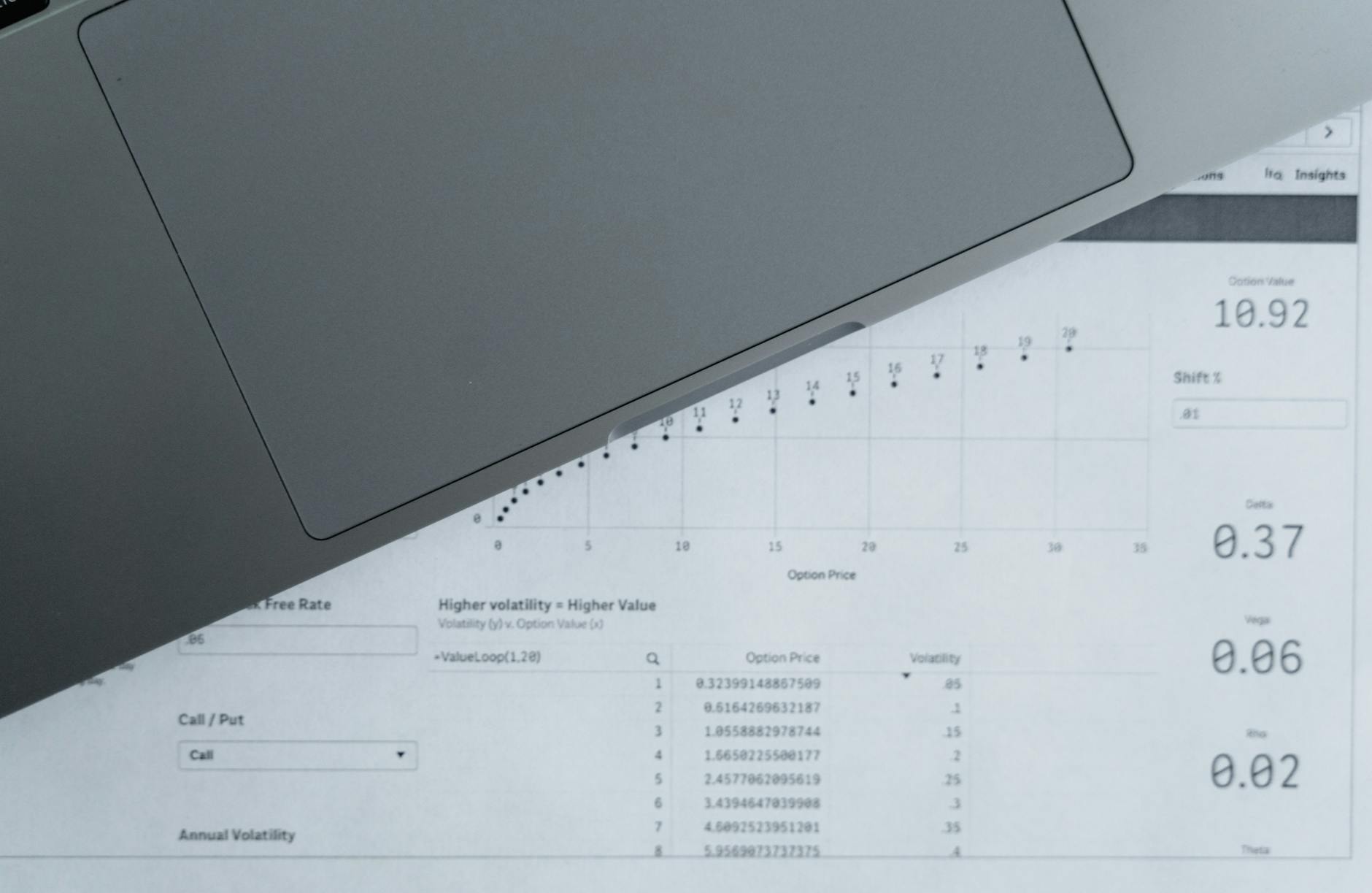

Automation in financial reporting streamlines repetitive tasks such as data collection, consolidation, and compliance checks. By removing manual processes, organizations increase efficiency and accuracy while freeing finance professionals to focus on strategic analysis.

Alongside automation, enhanced data visualization tools play a crucial role in improving how financial information is communicated. Interactive dashboards, heat maps, and dynamic charts allow users to explore data from multiple perspectives, uncover hidden insights, and support data-driven storytelling. These visualizations make complex financial analytics accessible even to stakeholders without deep technical expertise, fostering better collaboration and alignment across departments.

Cloud adoption and data governance in business intelligence

The rise of cloud technology has accelerated the scalability and accessibility of data analytics platforms, enabling organizations to integrate diverse data sources and share financial insights securely across distributed teams. Cloud environments facilitate real-time reporting by supporting large volumes of streaming data with minimal latency.

At the same time, managing the integrity, security, and compliance of financial data becomes more critical. Strong data governance frameworks ensure that information remains accurate, auditable, and compliant with regulations such as SOX, GDPR, or IFRS. Combining cloud flexibility with rigorous governance establishes a trustworthy foundation for business intelligence initiatives, helping organizations build confidence in their data-driven decisions.

| Trend | Impact on financial reporting | Benefit for business intelligence |

|---|---|---|

| AI and machine learning | Improves accuracy, automates anomaly detection | Enables deeper insights and dynamic models |

| Real-time data and predictive analytics | Allows instant reporting and forward-looking forecasts | Supports proactive decision-making and risk mitigation |

| Automation and data visualization | Streamlines reporting processes and enhances readability | Facilitates collaboration and data-driven storytelling |

| Cloud adoption and data governance | Ensures scalable access and compliance | Builds trust in data and supports seamless sharing |

Conclusion

In summary, the landscape of data analytics and financial reporting within business intelligence is rapidly evolving due to key technological advancements and shifting business needs. The integration of AI and machine learning is enhancing analytical precision, while real-time data and predictive analytics are delivering more timely and forward-looking insights. Automation paired with advanced visualization tools is streamlining processes and improving communication, making financial data more accessible and actionable. Meanwhile, cloud technology combined with robust data governance frameworks ensures scalable, secure, and compliant environments critical for trustworthy reporting. Together, these trends are transforming traditional financial reporting into a dynamic driver of strategic decision-making that empowers businesses to navigate complexity and stay competitive.

Image by: Tima Miroshnichenko

https://www.pexels.com/@tima-miroshnichenko

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua