Maximizing Cost Optimization with Accounting Analytics

Maximizing cost optimization with accounting analytics is an essential strategy for businesses aiming to enhance profitability while maintaining operational efficiency. In today’s competitive market, companies need more than just traditional accounting methods; they require advanced analytics to uncover hidden cost-saving opportunities and drive smarter financial decisions. This article explores how integrating accounting analytics can transform cost management by providing real-time insights, identifying cost drivers, and enabling proactive budgeting. By leveraging data intelligently, organizations can move beyond reactive cost-cutting measures and develop sustainable strategies for optimizing expenses in a dynamic business environment. Whether you are a CFO, finance manager, or business owner, understanding the synergy between accounting analytics and cost optimization is crucial for long-term success.

The role of accounting analytics in cost management

Accounting analytics involves the systematic analysis of financial data to extract actionable insights. Unlike traditional accounting, which primarily focuses on recording transactions and generating reports, accounting analytics uses data modeling, forecasting, and visualization techniques to highlight patterns and trends affecting costs.

By applying accounting analytics, companies can:

- Identify cost centers with excessive expenditures

- Analyze spending patterns across departments

- Forecast future expenses based on historical trends

- Uncover inefficiencies and waste in procurement or operations

This approach allows businesses to have a granular understanding of where money is being spent and how to strategically target cost reduction without compromising quality or growth.

Data integration and real-time insight generation

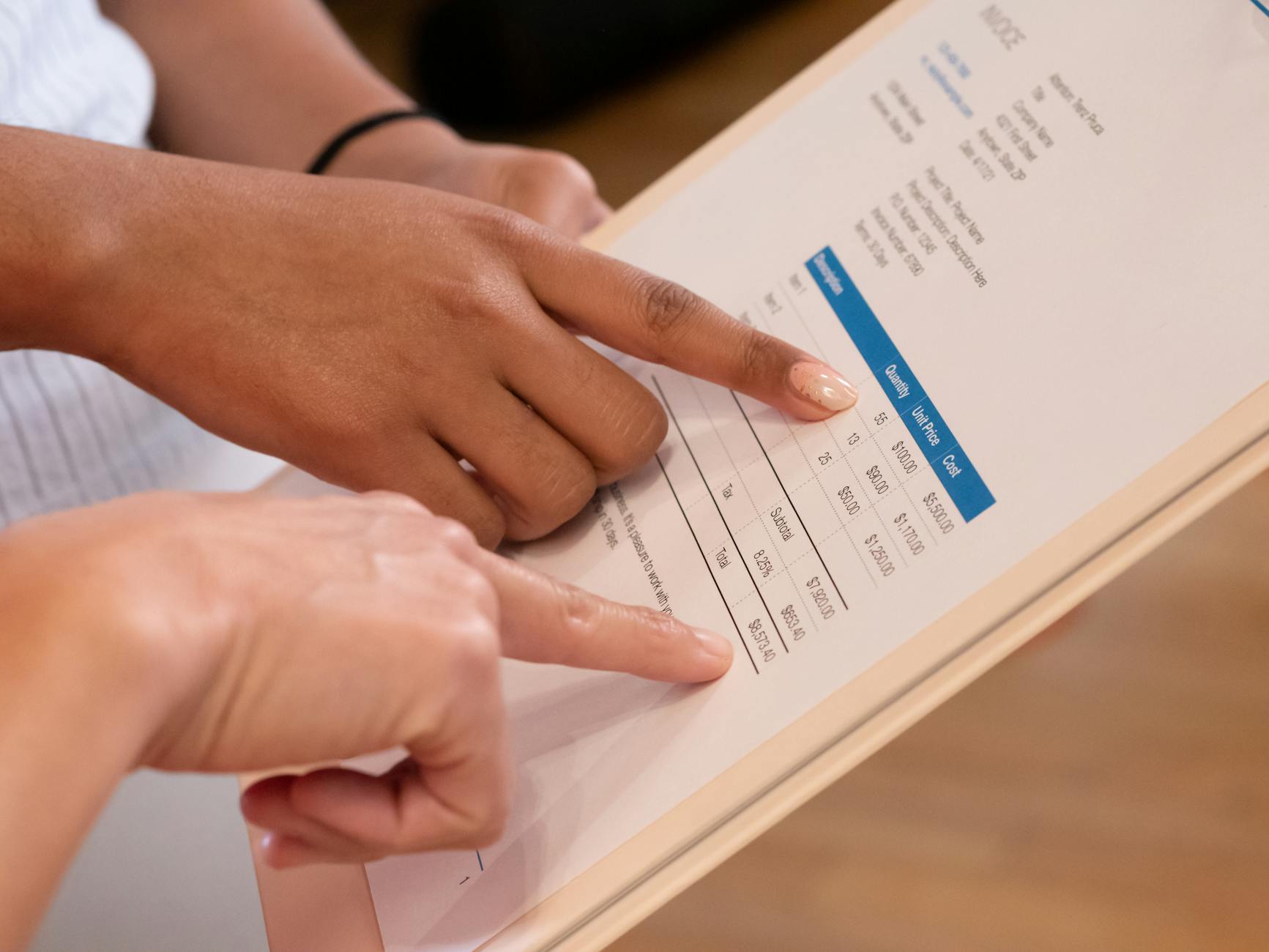

Achieving effective cost optimization requires access to integrated data from various financial and operational systems. Accounting analytics platforms consolidate information from ERP systems, payroll, procurement, and other sources into a unified dashboard.

Real-time insight is a critical advantage here. Finance teams can monitor key performance indicators (KPIs) such as:

| KPI | Purpose | Benefit |

|---|---|---|

| Cost variance analysis | Compare actual costs against budgets | Immediate identification of overspending |

| Expense trend tracking | Monitor month-over-month or quarter-over-quarter expenses | Detect anomalies or spikes early |

| Supplier cost benchmarking | Evaluate vendor pricing against industry standards | Negotiate better contracts or find alternatives |

These insights enable quicker responses, reducing the risk of cost overruns and improving overall financial control.

Predictive analytics for proactive budgeting

Another powerful facet of accounting analytics is predictive analytics, which forecasts future costs using historical and real-time data. This capability empowers finance teams to move beyond reactive adjustments and implement proactive budgeting strategies.

With predictive models, businesses can:

- Project costs under various business scenarios

- Estimate the financial impact of market changes, such as raw material price fluctuations

- Allocate resources more effectively to high-return areas

- Plan capital expenditures with greater accuracy

By anticipating cost trends, companies can avoid surprises and build more resilient financial plans that align with strategic goals.

Driving continuous improvement through actionable insights

Cost optimization is not a one-time initiative but an ongoing process. Accounting analytics supports continuous improvement by providing a feedback loop that informs decision-making at every level of the organization. Key actions enabled by this feedback include:

- Regularly refining cost control policies based on data-driven evidence

- Empowering department heads with tailored dashboards to monitor budgets

- Identifying training needs to reduce operational inefficiencies

- Benchmarking performance against industry peers to set cost targets

Moreover, an analytics-driven culture fosters transparency and accountability, encouraging collaboration between finance and operational teams to sustain long-term cost discipline.

Conclusion

In summary, maximizing cost optimization through accounting analytics offers a transformative approach to financial management. By harnessing the power of data analysis, businesses gain clarity on cost structures, enable real-time monitoring, and adopt predictive budgeting practices. The integration of diverse data sources facilitates comprehensive insight generation that helps detect inefficiencies early and guides resource allocation decisions more effectively. Additionally, fostering continuous improvement through analytics promotes a proactive and collaborative financial culture that strengthens overall cost competitiveness. For organizations seeking sustainable growth and improved profitability, embracing accounting analytics is not just an option but a strategic imperative that unlocks smarter and more efficient cost management practices.

Image by: Kindel Media

https://www.pexels.com/@kindelmedia

editor's pick

latest video

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua