Maximizing Cost Optimization with Accounting Analytics

Maximizing cost optimization with accounting analytics is a transformative approach that enables businesses to leverage financial data for smarter decision-making and enhanced efficiency. In today’s competitive market, companies seek methods to reduce expenses while maintaining quality and productivity. Accounting analytics offers a systematic examination of financial records and trends, providing deep insights into cost structures and expenditure patterns. By integrating advanced analytical tools with traditional accounting practices, organizations can identify hidden savings, predict future costs, and streamline budgeting processes. This article explores how accounting analytics can be strategically applied to maximize cost optimization, focusing on data-driven analysis, technology integration, process improvement, and continuous monitoring to create sustainable financial benefits.

Understanding accounting analytics and its role in cost management

Accounting analytics involves the gathering, processing, and evaluation of financial data to inform business decisions. Unlike standard accounting, which focuses on recording and reporting, analytics transforms raw data into actionable insights using statistical models, machine learning, and visualization tools. This shift empowers finance teams to pinpoint inefficiencies in spending, forecast financial outcomes accurately, and uncover cost-saving opportunities. For example, analyzing vendor payments or operational expenses can highlight inconsistencies or waste, prompting targeted interventions. Understanding these dynamics is fundamental for cost optimization, as it moves businesses from reactive cost-cutting to proactive financial strategy.

Leveraging technology to enhance financial data analysis

The integration of technology is a cornerstone of effective accounting analytics. Tools such as ERP systems, AI-powered analytics platforms, and cloud-based accounting software enable real-time data access and deeper examination of financial patterns. These technologies automate routine tasks like data entry and reconciliation, reducing errors and increasing efficiency. They also offer predictive analytics, helping organizations anticipate future expenditure trends and adjust budgets accordingly. By deploying such technologies, companies gain agility in financial management, allowing them to respond swiftly to market changes while optimizing resource allocation.

Implementing data-driven decision making for cost control

Data-driven decision making forms the practical application of accounting analytics in cost optimization. It involves using insights derived from financial data to guide budgeting, procurement, and operational strategies. Organizations can segment costs by department or project, compare actual spend against budgets, and evaluate cost-benefit ratios. This granular approach enables prioritizing investments that yield the highest returns and eliminating non-essential expenses. Additionally, scenario analysis based on data helps in preparing for financial uncertainties, ensuring cost control measures are both effective and adaptable.

Continuous monitoring and refinement for sustained savings

Maximizing cost optimization is not a one-time event but an ongoing process. Continuous monitoring of financial metrics through dashboards and key performance indicators (KPIs) allows businesses to track cost-saving initiatives and adjust tactics as needed. Regular audits combined with updated analytics provide feedback loops for improving forecasting models and refining cost management policies. This iterative approach ensures that organizations remain vigilant against cost overruns and capitalize consistently on emerging efficiency opportunities.

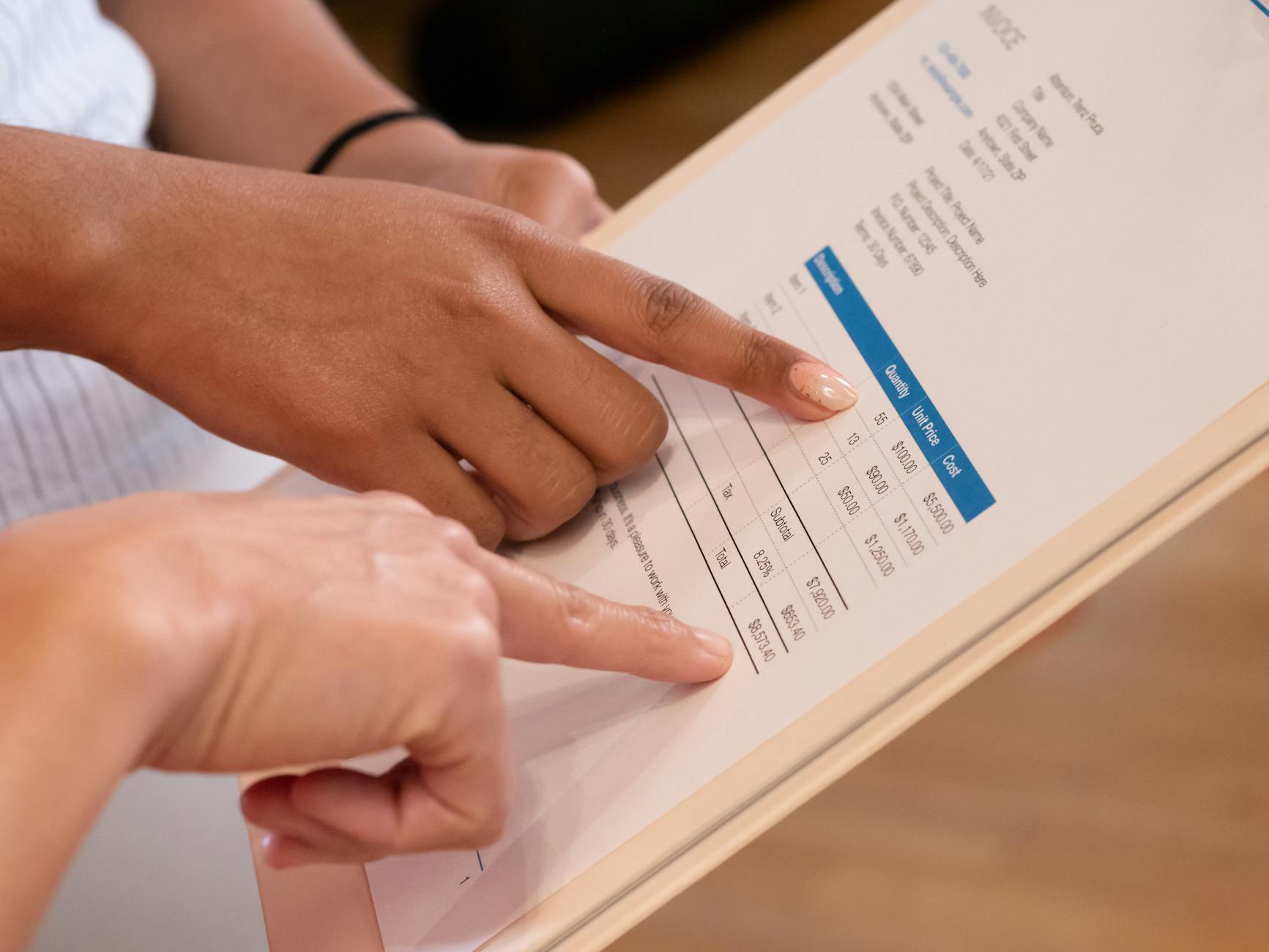

| Aspect | Benefits | Tools/Methods |

|---|---|---|

| Data analysis | Identify inefficiencies, forecast costs accurately | Statistical models, data visualization |

| Technology integration | Real-time insights, automation of repetitive tasks | ERP systems, AI analytics platforms |

| Data-driven decisions | Prioritize spend, optimize budgeting | Cost segmentation, scenario analysis |

| Continuous monitoring | Sustained savings, adaptive cost control | KPI dashboards, regular audits |

Conclusion

In summary, maximizing cost optimization through accounting analytics is a comprehensive strategy that transforms financial data into a powerful tool for business success. By understanding accounting analytics, leveraging modern technologies, and applying data-driven decision making, organizations can uncover actionable insights that reduce costs and improve budget efficiency. Furthermore, continuous monitoring and refinement ensure that these cost-saving advantages are maintained over time, creating a resilient financial framework. Embracing accounting analytics not only streamlines expenses but also supports strategic planning, helping companies stay competitive and profitable in an evolving economic landscape.

Image by: Kindel Media

https://www.pexels.com/@kindelmedia

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua