Maximizing Cost Optimization with Accounting Analytics

Maximizing cost optimization with accounting analytics is a transformative approach that businesses can harness to enhance financial efficiency. In today’s competitive market, organizations strive to reduce expenses while maintaining or improving operational output. Traditional accounting methods, although effective, often overlook deeper insights available through advanced analytics. By leveraging accounting analytics, companies can gain a clearer understanding of their cost structures, identify inefficiencies, predict future trends, and make data-driven decisions that directly impact their bottom line. This article explores how integrating accounting analytics into financial processes empowers businesses to optimize costs strategically, improve resource allocation, and foster sustainable growth.

Understanding the role of accounting analytics in cost management

Accounting analytics refers to the use of data analysis techniques applied to accounting data to uncover patterns, trends, and anomalies. These insights are invaluable for cost optimization because they provide a granular view of expenses across departments, projects, and suppliers. Unlike traditional reporting that looks at historical data, analytics enables proactive monitoring and forecasting, allowing companies to anticipate cost spikes and mitigate risks before they escalate.

With accounting analytics, organizations can segment costs by categories such as fixed vs. variable expenses, direct vs. indirect costs, and discretionary vs. non-discretionary spending. This segmentation helps clarify where cost-saving opportunities lie and which areas require better control, facilitating more targeted interventions.

Leveraging predictive analytics for proactive cost control

One of the key advantages of accounting analytics is the ability to use predictive models to forecast future costs and financial outcomes. Predictive analytics combines historical accounting data with external variables to create scenarios that inform budgeting and resource planning.

For example, if data shows a rising trend in raw material costs, predictive analytics can forecast its impact on production expenses and suggest alternative sourcing strategies or inventory adjustments. This proactive approach enables businesses to avoid budget overruns and adjust their strategies in real time.

Optimizing operational efficiency through real-time cost tracking

Real-time cost tracking powered by accounting analytics tools allows businesses to monitor expenses continuously rather than waiting for monthly or quarterly reports. This immediacy supports quick decision-making when inefficiencies are detected.

For instance, a company might discover that a particular supplier’s costs have increased unexpectedly or that certain projects are consuming more resources than planned. Immediate visibility into such issues enables timely corrective actions such as negotiating contracts, reallocating budgets, or revising project plans.

Integrating accounting analytics with broader financial strategies

Accounting analytics does not operate in isolation; it complements broader financial and operational strategies. When integrated with other business intelligence and enterprise resource planning (ERP) systems, analytics provide a comprehensive view that enhances overall financial health.

This integration supports cross-functional collaboration between finance, procurement, and operations teams to align objectives and reduce redundant or unnecessary spending. Additionally, the insights gained can drive continuous improvement initiatives and strategic investments that foster long-term cost efficiency.

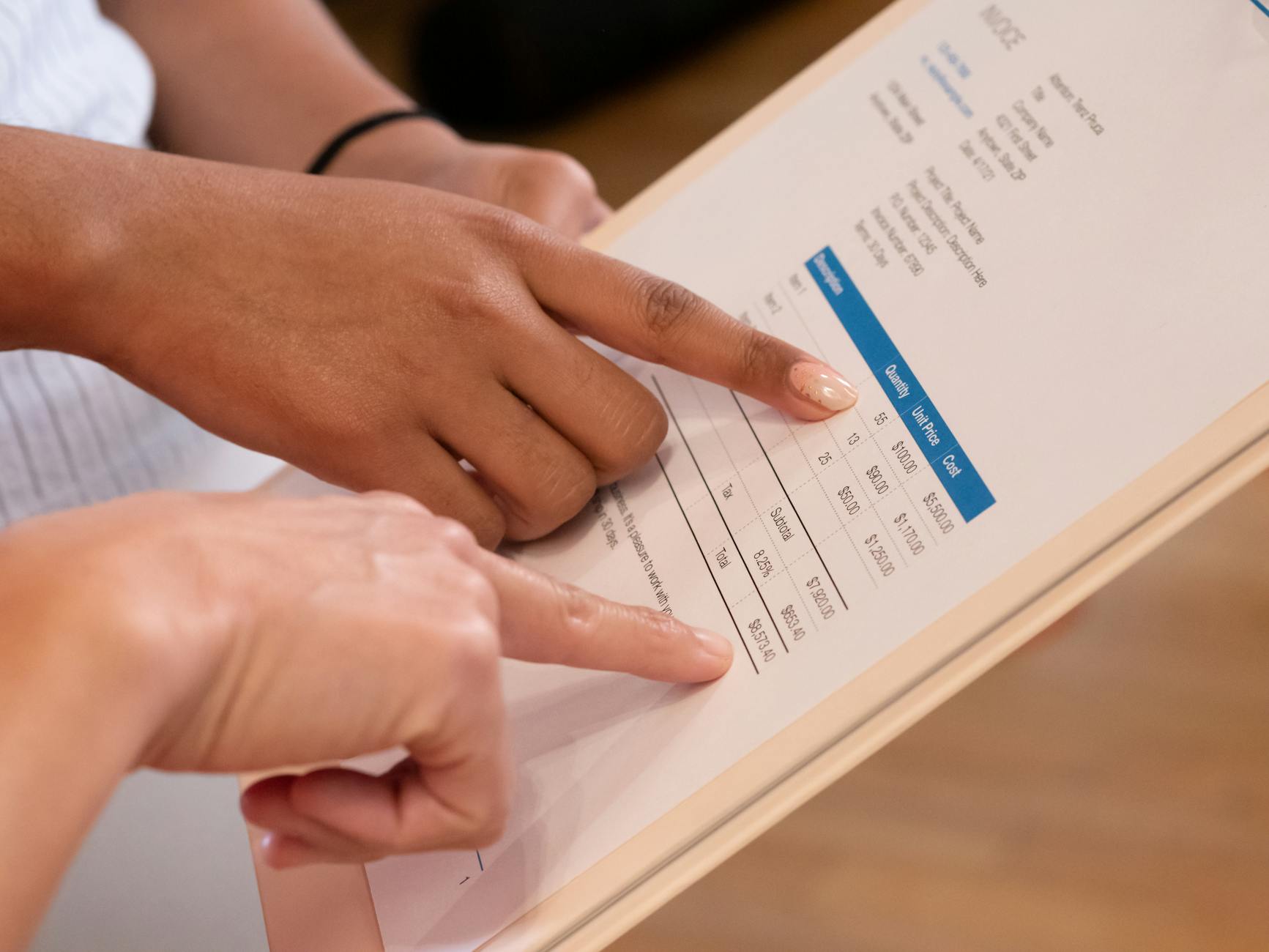

| Application | Benefits | Example |

|---|---|---|

| Cost segmentation analysis | Identifies cost-saving opportunities and cost drivers | Separating fixed and variable costs to adjust production levels |

| Predictive cost forecasting | Enables proactive budget adjustments | Forecasting supplier price increases and adjusting orders |

| Real-time expense monitoring | Supports immediate corrective action | Detecting unexpected project overspending early |

| Financial strategy integration | Enhances cross-departmental alignment and resource allocation | Linking procurement and finance for joint cost control initiatives |

In conclusion, maximizing cost optimization through accounting analytics offers a comprehensive approach to understanding, anticipating, and controlling expenses more effectively. By moving beyond traditional accounting methods and embracing data-driven insights, businesses can gain enhanced visibility into their financial operations, enabling smarter decisions that reduce waste and improve profitability. Predictive analytics facilitate proactive cost management, while real-time tracking ensures rapid responses to emerging issues. When these analytics are integrated into broader financial strategies, organizations benefit from aligned operational goals and sustained cost efficiencies. Ultimately, accounting analytics transforms cost optimization from a reactive practice into a strategic advantage that drives lasting business success.

Image by: Kindel Media

https://www.pexels.com/@kindelmedia

editor's pick

latest video

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua