Financial Modeling Best Practices for Mergers and Acquisitions

Financial modeling best practices for mergers and acquisitions are a critical component of successful deal-making. Mergers and acquisitions (M&A) involve significant financial, operational, and strategic complexities, and an accurate, well-structured financial model provides invaluable insight into the potential outcomes of a transaction. This article explores essential best practices that finance professionals should adopt when building models for M&A. The techniques outlined will help enhance the reliability and clarity of financial projections, facilitate informed decision-making, and mitigate risks commonly associated with these high-stakes processes. Whether you are a financial analyst, corporate development professional, or investor, understanding these principles is key to creating robust models that drive value and support confident negotiations.

Understand the strategic context and objectives

Before diving into numbers, it’s imperative to grasp the strategic rationale behind the merger or acquisition. Financial models should reflect the unique goals of the deal, such as cost synergies, revenue enhancement, market expansion, or diversification. This clarity guides assumptions and scenario development within the model.

Start with a thorough due diligence process to capture the acquired company’s financial health, operational metrics, and growth prospects. Align financial assumptions with the strategic objectives—overly optimistic projections may mislead decision-makers, while more conservative estimates can highlight risks and identify areas requiring attention.

Build a modular and flexible model structure

A modular design ensures each component of the financial model—revenue, costs, capital expenditures, financing structure, and taxes—is built as a distinct, yet interconnected, block. This approach improves transparency and allows for easier updates when new information emerges.

Flexibility is essential in M&A modeling because assumptions may shift rapidly based on due diligence findings or changes in market conditions. Employing dynamic inputs and scenario analysis capabilities enables users to test various outcomes quickly, such as different purchase price scenarios or integration cost levels.

| Model component | Purpose | Key elements |

|---|---|---|

| Revenue projections | Forecast future sales | Market growth, pricing strategies, synergies |

| Cost assumptions | Estimate operating and integration expenses | Fixed vs variable costs, synergy realization timeline |

| Capital expenditures | Plan investments needed post-transaction | Maintenance capex, expansion capex |

| Financing structure | Detail debt and equity components | Interest rates, repayment schedules, issuance costs |

Ensure rigorous due diligence and data validation

Accurate inputs are the backbone of a reliable financial model. Extensive due diligence should validate historical financial statements and scrutinize cash flow patterns, liabilities, contingent risks, and one-time items. This step reduces surprises post-deal and increases confidence in the model’s forecasts.

Cross-check all data points from multiple sources and incorporate input from legal, tax, and operational teams. Avoid hardcoding values without clear documentation, and apply sensitivity checks, stress tests, and peer comparisons to identify potential inconsistencies.

Incorporate synergies and integration planning realistically

Financial models must explicitly include expected synergies—cost savings and revenue enhancements realized by combining the two companies. Model timelines should acknowledge that these benefits typically materialize gradually, not immediately.

Underestimating integration complexity can lead to materially flawed valuations. Break down synergy estimates by category such as supply chain, overhead, and sales channels. Reflect integration costs and delays to provide a balanced view.

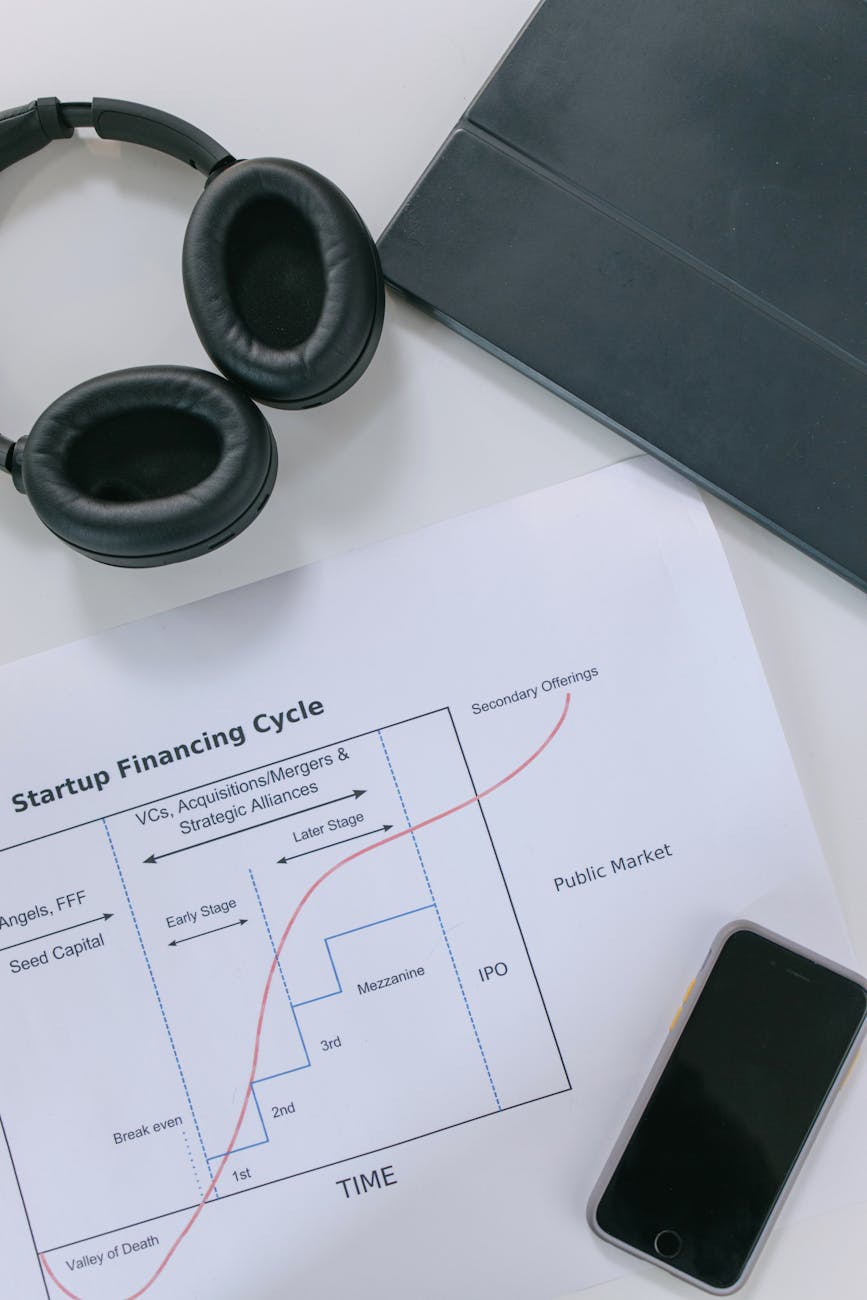

Present results clearly for decision-making

A financial model’s utility ultimately depends on how effectively its results are communicated. Use clear, concise summaries supported by key metrics such as EBITDA impact, free cash flow, IRR, and payback period. Visual aids like charts and scenario comparison tables help stakeholders grasp implications swiftly.

Maintain transparency by documenting assumptions and methodologies within the model or in accompanying notes. This fosters trust and facilitates smoother negotiations and approvals.

In conclusion, building financial models for mergers and acquisitions requires a disciplined approach grounded in understanding strategic goals, creating modular and adaptable frameworks, and validating data rigorously. Incorporating realistic synergy timelines and presenting insights clearly further elevates model usefulness. Adhering to these best practices empowers deal teams to evaluate risks and opportunities with confidence, ultimately supporting more informed decisions that maximize transaction value and success.

Image by: Ivan Samkov

https://www.pexels.com/@ivan-samkov

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua