Key Trends in Data Analytics and Financial Reporting for Business Intelligence

Key trends in data analytics and financial reporting for business intelligence are rapidly evolving, driven by advances in technology and increasing demand for real-time insights. As businesses strive to stay competitive, leveraging data analytics and innovative financial reporting tools has become essential to making informed decisions. This article explores the emerging trends that are reshaping how organizations collect, interpret, and utilize financial data for enhanced business intelligence. By understanding these developments, companies can optimize their financial strategies, improve operational efficiencies, and gain a clearer view of their market position. We will delve into predictive analytics, automation in financial reporting, integration of AI, data visualization advancements, and the growing importance of data governance to provide a comprehensive view of current industry shifts.

Predictive analytics transforming financial forecasting

Predictive analytics is revolutionizing how businesses approach financial forecasting and decision making. By using historical and real-time data, predictive models identify patterns and project future financial outcomes with increasing accuracy. This trend is helping companies anticipate market fluctuations, optimize budgeting, and manage risks proactively. Machine learning algorithms, a crucial component of predictive analytics, continuously improve forecasting models by learning from new data inputs, making financial planning more dynamic and reliable. As a result, traditional static reports are being supplemented or replaced by adaptive models that can adjust forecasts based on market or operational changes, increasing their relevance and usefulness.

Automation streamlining financial reporting processes

Automation is another key trend that is deeply impacting financial reporting by reducing manual efforts and minimizing errors. Automated tools can collect, validate, and consolidate financial data from various sources, making report generation faster and more accurate. This shift allows finance teams to focus on analysis rather than data entry or reconciliation tasks. Robotic process automation (RPA) and intelligent automation platforms are becoming commonplace for generating compliance reports, financial statements, and performance dashboards. Automation also ensures adherence to regulatory requirements through consistent application of rules and audit trails, significantly enhancing the reliability of financial reports.

AI integration enhancing insights and decision-making

Artificial intelligence (AI) is closely linked to both predictive analytics and automation, augmenting business intelligence capabilities. AI can analyze vast datasets much faster than traditional systems and identify complex correlations that would be difficult for humans to detect. For example, AI-powered anomaly detection can spot irregularities in financial statements, enabling quicker fraud detection or error correction. Furthermore, natural language processing (NLP) integrated into financial reporting platforms allows for generating more intuitive and accessible reports. This integration drives smarter insights and supports strategic decision-making by providing tailored and timely analytics that are easy to interpret.

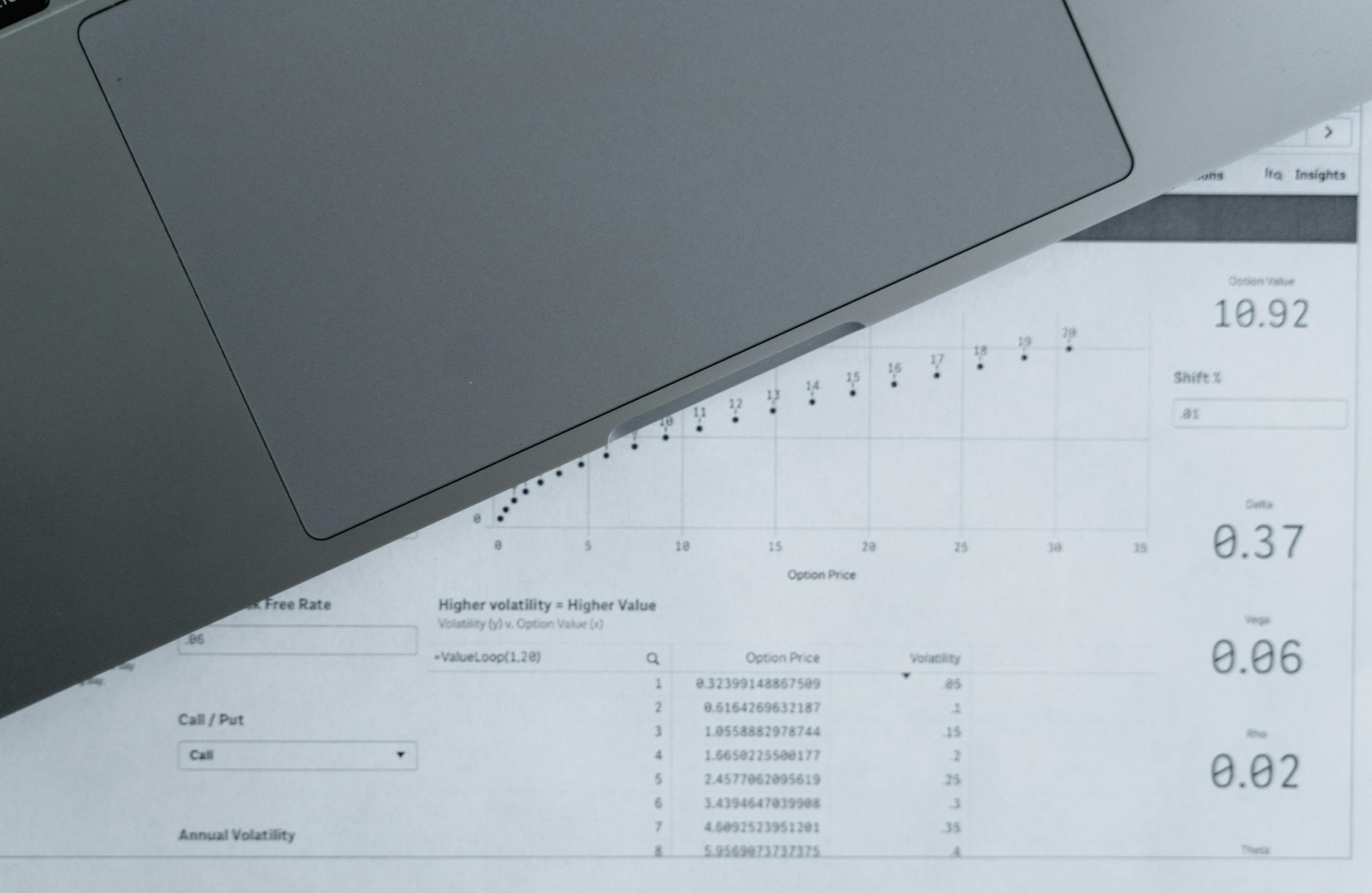

Advanced data visualization for improved communication

Data visualization continues to evolve, playing a critical role in how financial data is communicated to stakeholders. Modern visualization tools move beyond basic charts and graphs by incorporating interactive dashboards, real-time updates, and story-telling capabilities. Enhanced visualization enables stakeholders without deep financial expertise to understand key metrics and trends easily, fostering data-driven cultures within organizations. Visual analytics tools often integrate with business intelligence systems, providing deeper drill-downs into financial results and operational data simultaneously. This layered approach helps identify root causes behind the numbers, supporting more informed and confident business decisions.

Data governance and compliance gaining prominence

With the rise of big data and complex analytics, proper data governance is essential to ensure data quality, security, and regulatory compliance. Governments and industry bodies are imposing stricter reporting standards, requiring transparent and auditable financial disclosures. Organizations are adopting robust data governance frameworks to manage data integrity and privacy across integrated financial systems. This trend emphasizes the importance of data stewardship roles, comprehensive metadata management, and automated controls to minimize compliance risks. Effective data governance also enhances trust in analytics outputs, making financial reporting both reliable and actionable for decision-makers.

| Trend | Description | Business impact |

|---|---|---|

| Predictive analytics | Using data and algorithms to forecast financial outcomes. | Improved financial planning and risk management. |

| Automation | Streamlining data processing and report generation. | Reduced manual error and faster report delivery. |

| AI integration | Enhancing data analysis and anomaly detection. | Smarter insights and fraud prevention. |

| Advanced visualization | Interactive dashboards and real-time data updates. | Clearer communication and data-driven culture. |

| Data governance | Ensuring data accuracy, security, and compliance. | Reliable reporting and regulatory adherence. |

Conclusion

The landscape of data analytics and financial reporting is being transformed by several interconnected trends that together enhance business intelligence capabilities. Predictive analytics provides forward-looking insights critical for agile financial planning, while automation streamlines routine processes to improve efficiency and accuracy. The integration of AI introduces advanced intelligence in data assessment and fraud prevention, making financial information more reliable and actionable. Meanwhile, advancements in data visualization bridge the gap between complex data and stakeholder understanding, fostering better communication and decision-making. Underpinning these technological changes is the crucial emphasis on data governance, ensuring compliance and maintaining the integrity of financial data. Businesses that embrace these trends will be better positioned to harness their data’s full potential and drive sustained growth and competitive advantage.

Image by: Tima Miroshnichenko

https://www.pexels.com/@tima-miroshnichenko

editor's pick

latest video

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua