Leveraging AI for Scalable Accounting Solutions in Tech Startups

Leveraging AI for scalable accounting solutions in tech startups

In the fast-paced world of tech startups, financial management often becomes a bottleneck as companies struggle to keep up with rapid growth and complex regulations. Traditional accounting methods can be slow, error-prone, and costly, placing undue pressure on lean teams. Enter artificial intelligence (AI)—an emerging game-changer that offers scalable, efficient, and accurate accounting solutions tailored for startups. By automating routine processes, improving data accuracy, and providing insightful financial analytics, AI enables startups to streamline their accounting workflows and make informed decisions swiftly. This article explores how AI technology is transforming startup accounting, from automating bookkeeping to enhancing financial planning, ultimately empowering businesses to scale without sacrificing financial control.

Automating routine accounting tasks

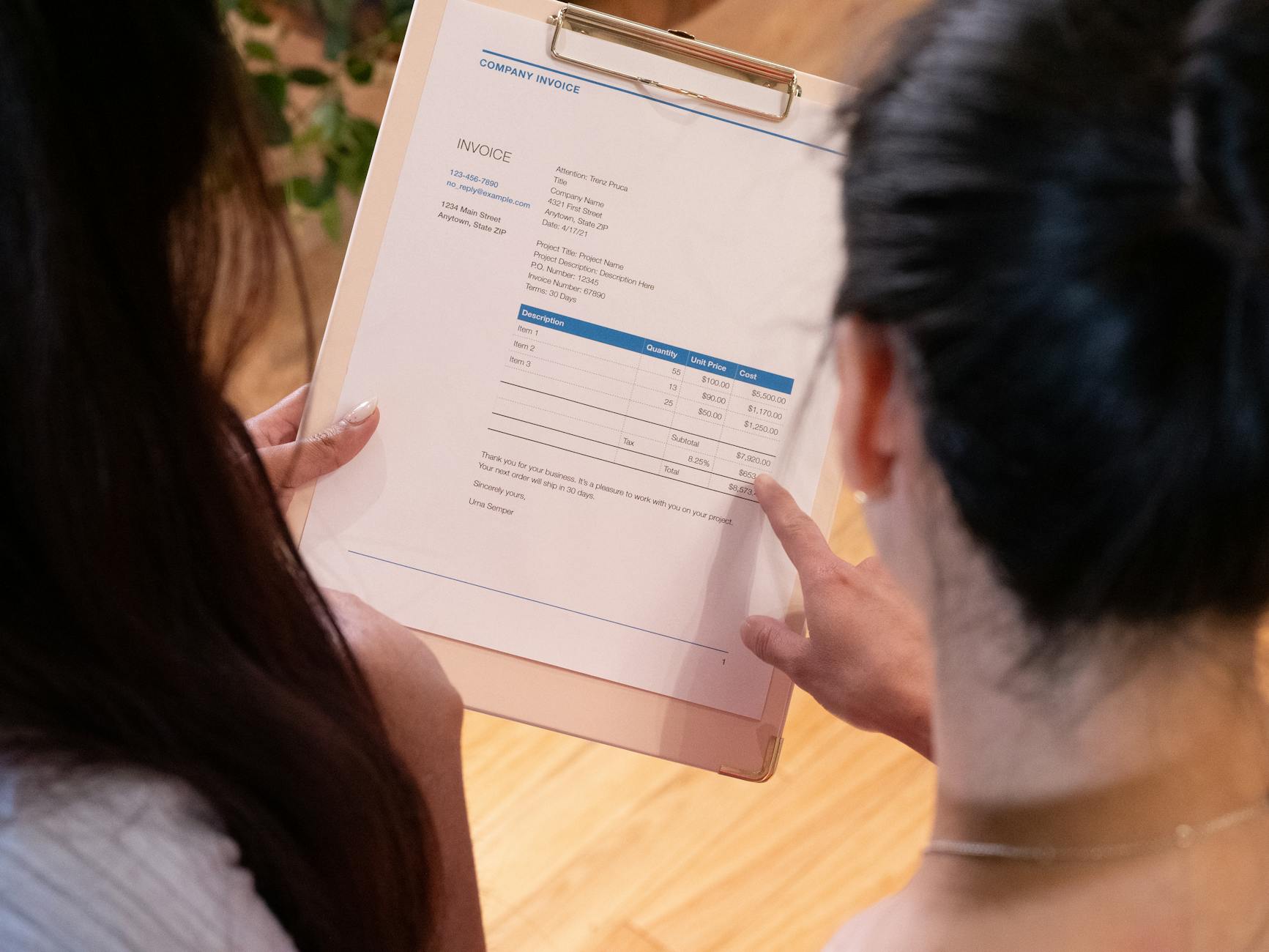

One of the primary benefits AI brings to startups is the automation of repetitive accounting tasks such as invoice processing, transaction categorization, and expense tracking. AI-powered platforms use machine learning algorithms to accurately classify expenses and match invoices with purchase orders, drastically reducing manual data entry errors. This automation frees up valuable time for startup teams, allowing them to focus on higher-level strategic activities rather than mundane bookkeeping chores. Furthermore, AI can continuously improve its accuracy by learning from historical data, adapting to unique company processes over time.

Improving financial data accuracy and compliance

Accurate financial records are essential for startups seeking investment, regulatory compliance, and tax reporting. AI enhances data integrity by detecting anomalies, flagging discrepancies, and verifying transactions in real time. For instance, AI-powered audit tools can automatically scan financial statements for inconsistencies and potential fraud, minimizing the risk of costly errors or compliance violations. Additionally, AI solutions can be configured to stay updated with dynamic tax laws and reporting standards, helping startups meet legal requirements even as regulations evolve.

Enhancing financial forecasting and decision-making

Beyond bookkeeping, AI also plays a crucial role in financial analytics and forecasting, essential for startup growth planning. By analyzing historical financial data along with external market trends, AI models can predict cash flow, revenue growth, or expense patterns with greater precision. This level of insight empowers startup founders and CFOs to make data-driven decisions about budgeting, resource allocation, and funding strategies. Moreover, AI-driven dashboards and visualization tools consolidate key financial metrics in an accessible format, improving transparency and communication across teams.

Scalability and integration with startup tools

Tech startups thrive on agility, and scalable accounting systems must integrate smoothly with existing tools such as CRM, payroll, and project management software. AI-based accounting solutions are designed with flexibility in mind, supporting cloud integration and real-time data synchronization. As a startup grows and adds new sales channels or funding sources, AI systems can easily scale alongside by handling increasing transaction volumes without compromising performance. This seamless integration reduces administrative overhead and ensures that financial data remains consolidated and accurate.

| AI Accounting Feature | Benefits for Startups | Examples |

|---|---|---|

| Automation of routine tasks | Saves time, reduces errors, and improves efficiency | Invoice matching, expense categorization |

| Real-time accuracy and compliance checks | Reduces risk, ensures regulatory adherence | Anomaly detection, tax updates |

| Predictive financial analytics | Supports strategic planning and cash flow management | Forecasting revenue, budgeting insights |

| Scalability and integration | Accommodates growth, streamlines workflows | Cloud sync, multi-platform connectivity |

Conclusion

AI-driven accounting solutions offer tech startups a powerful way to scale their financial operations without sacrificing accuracy or compliance. By automating routine bookkeeping tasks, improving data integrity, and delivering advanced financial analytics, AI empowers startups to better manage cash flow, comply with regulatory requirements, and make informed strategic decisions. Moreover, the flexibility and scalability of AI-enabled platforms ensure these tools grow alongside startups, seamlessly integrating with multiple business applications. As the competitive pressure grows in the tech ecosystem, leveraging AI in accounting is not just a luxury but an essential step to maintaining agility and financial health. Embracing AI-driven accounting transforms finance from a back-office function to a strategic enabler of startup success.

Image by: Kindel Media

https://www.pexels.com/@kindelmedia

editor's pick

latest video

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua