Maximizing Cost Optimization with Accounting Analytics

Maximizing cost optimization with accounting analytics is an essential strategy for businesses aiming to enhance financial efficiency and improve decision-making processes. As companies strive to maintain competitive advantages, traditional accounting methods alone may fall short in revealing comprehensive insights about cost structures and opportunities for saving. Accounting analytics incorporates advanced data analysis techniques, allowing organizations to examine financial data in real time, identify cost drivers, and develop targeted strategies to reduce waste. This approach not only supports better budgeting and forecasting but also strengthens overall financial health. In this article, we will explore the key components of accounting analytics, its role in cost optimization, and practical steps businesses can take to leverage these insights effectively.

Understanding accounting analytics

Accounting analytics combines accounting principles with data analytics to deliver a deeper understanding of financial information. It involves collecting, processing, and analyzing accounting data to identify patterns, trends, and anomalies. Unlike traditional accounting, which focuses primarily on reporting historical financial data, accounting analytics is forward-looking and predictive. Through techniques such as variance analysis, trend evaluation, and benchmarking, businesses can uncover hidden inefficiencies and areas where costs can be controlled more effectively.

For example, accounting analytics tools can analyze overhead cost fluctuations and relate them to operational changes, helping managers pinpoint unnecessary expenditures or inefficient resource allocation. This detailed insight is crucial for companies aiming to trim costs without sacrificing quality or performance.

Identifying cost drivers and inefficiencies

One of the core advantages of accounting analytics is its ability to identify specific cost drivers — the factors that cause changes in an organization’s cost structure. These drivers vary widely depending on the industry and operational model but can include labor hours, material usage, production volume, or supplier pricing.

By using data visualization and dashboard tools, finance teams can track cost drivers more effectively and detect inefficiencies. For instance, accounting analytics might reveal that overtime labor costs disproportionately increase during certain periods, or that specific suppliers consistently contribute to higher raw material expenses. Addressing these insights helps reduce unnecessary spending and optimize procurement strategies.

Integrating predictive analytics with cost management

Beyond analyzing past and current data, predictive analytics uses statistical models and machine learning algorithms to forecast future cost trends. This capability allows companies to anticipate potential budget overruns and adjust strategies proactively. For example, if predictive models indicate rising transportation costs tied to seasonal fuel price increases, companies can explore alternative logistics solutions or negotiation tactics ahead of time.

Integrating predictive analytics into accounting workflows helps organizations move from reactive cost controls to proactive financial planning, leading to more agile and resilient operations.

Implementing a successful accounting analytics program

To maximize cost optimization, businesses must develop structured accounting analytics programs that include the following steps:

- Data consolidation: Centralize financial and operational data to create a comprehensive dataset for analysis.

- Tool selection: Choose appropriate analytics software that fits the company’s size and complexity.

- Skill development: Train accounting and finance personnel in data analysis and interpretation techniques.

- Continuous monitoring: Establish real-time dashboards and reporting mechanisms for ongoing cost tracking.

- Cross-department collaboration: Encourage communication between finance, operations, and procurement teams to implement cost-saving measures efficiently.

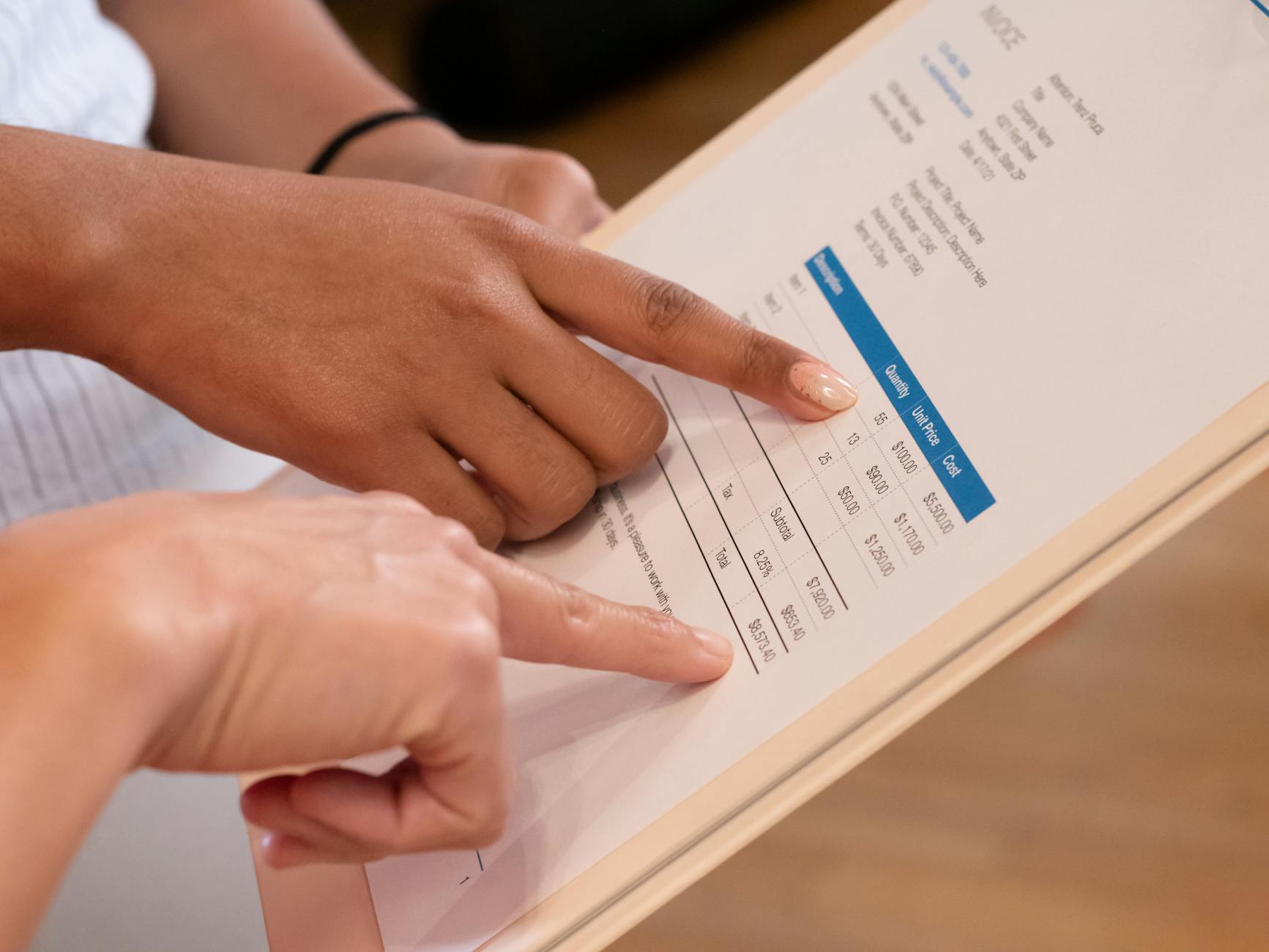

Here is a simple comparison table showing potential benefits before and after implementing accounting analytics:

| Aspect | Before accounting analytics | After accounting analytics |

|---|---|---|

| Cost visibility | Limited, retrospective | Comprehensive, real-time |

| Decision making | Based on intuition or delayed reports | Data-driven and proactive |

| Cost reduction opportunities | Reactive and inconsistent | Proactively identified and strategic |

| Forecast accuracy | Moderate, manual adjustments needed | Highly accurate, predictive models applied |

Conclusion

Maximizing cost optimization through accounting analytics represents a paradigm shift from traditional financial management to a more data-driven, strategic approach. By understanding the fundamentals of accounting analytics and identifying cost drivers, businesses can reveal inefficiencies and opportunities that previously went unnoticed. Incorporating predictive analytics enhances this advantage by enabling more accurate forecasting and proactive cost controls. Successfully implementing an accounting analytics program requires the right tools, continuous monitoring, and collaborative efforts across departments. Ultimately, organizations that embrace accounting analytics will find themselves with improved financial clarity, stronger budget discipline, and enhanced competitive positioning in their markets. Embracing these analytics-driven strategies ensures sustainable cost optimization and long-term business growth.

Image by: Kindel Media

https://www.pexels.com/@kindelmedia

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua