Maximizing Growth with Virtual CFO and Cloud Accounting Services

Maximizing Growth with Virtual CFO and Cloud Accounting Services

In today’s rapidly evolving business landscape, financial management plays a critical role in determining the success and growth potential of companies of all sizes. Small and medium-sized enterprises (SMEs) often face challenges in maintaining robust financial oversight due to limited in-house expertise or resources. This is where the integration of virtual CFO (Chief Financial Officer) services and cloud accounting platforms can transform business growth trajectories. By combining strategic financial leadership with advanced technology, businesses can access real-time insights, streamlined processes, and data-driven decision-making. In this article, we explore how virtual CFOs and cloud accounting services work synergistically to drive financial efficiency, scalability, and sustainable growth.

Understanding the role of a virtual CFO

A virtual CFO provides high-level financial guidance without the full-time expense of an in-house executive. These professionals bring expertise in financial planning, risk management, budgeting, and forecasting tailored to a company’s unique needs. Unlike traditional CFOs, virtual CFOs leverage technology to remotely share insights, allowing businesses to reduce overhead costs without sacrificing expertise.

Their strategic involvement ensures that financial decisions align with overall business objectives. By anticipating cash flow needs and identifying growth opportunities, a virtual CFO helps companies avoid pitfalls and capitalize on market potential.

Benefits of cloud accounting in modern financial management

Cloud accounting platforms have revolutionized traditional bookkeeping by offering accessibility, automation, and real-time data accuracy. These tools enable businesses to manage invoices, track expenses, and generate reports anytime and anywhere, significantly improving efficiency.

Security is another advantage, with cloud providers often implementing rigorous measures, including data encryption and regular backups. Additionally, cloud accounting fosters collaboration across departments and with external advisors, such as accountants and virtual CFOs, by providing centralized data access.

How virtual CFO and cloud accounting complement each other

While virtual CFOs provide strategic oversight, cloud accounting supplies the accurate, up-to-date financial data necessary for informed decision-making. This integration allows virtual CFOs to analyze trends, forecast financial outcomes, and advise on tactical moves quickly.

For example, with automated bookkeeping from cloud platforms, virtual CFOs spend less time on data collection and more time on value-adding activities like scenario planning or cost optimization. This synergy increases agility and responsiveness, helping businesses adapt to changing market conditions and scale efficiently.

Driving growth through data-driven strategies

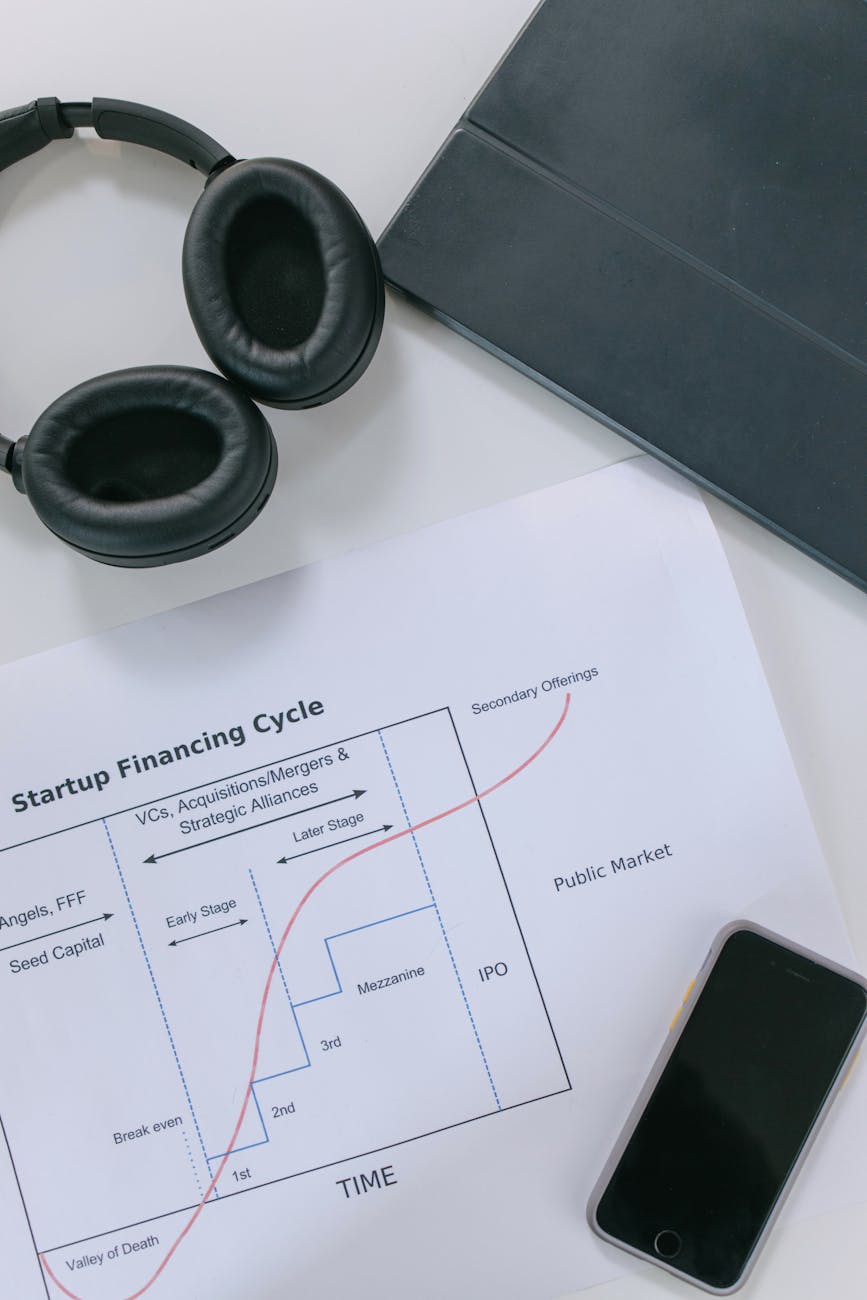

With the reliable financial frameworks provided by cloud accounting and expert insights from a virtual CFO, businesses can implement targeted growth strategies. These might include optimized pricing models, effective cash flow management, or investment prioritization.

Below is a table illustrating the impact of combining virtual CFO and cloud accounting on key business metrics:

| Metric | Before Integration | After Integration | Improvement (%) |

|---|---|---|---|

| Cash flow accuracy | 70% | 95% | 35% |

| Financial reporting speed | 10 days | 2 days | 80% |

| Cost savings on financial operations | Baseline | Reduced by 25% | 25% |

| Revenue growth rate | 5% annually | 12% annually | 140% |

This data highlights not only operational efficiencies but also substantial improvements in revenue generation and financial clarity.

Implementing solutions for long-term success

Successfully maximizing business growth requires more than just adopting new tools or hiring experts—it demands a cohesive strategy aligned with the company’s goals. Companies should start by assessing their current financial health and identifying gaps where external CFO expertise or cloud-based automation can bring immediate value.

Next, selecting the right cloud accounting software compatible with existing systems is crucial to ensure smooth integration. Ongoing communication between virtual CFOs, management, and accounting teams fosters transparency and drives continuous improvement.

Ultimately, merging virtual CFO services with cloud accounting creates a future-proof financial infrastructure capable of supporting innovation and scalability.

Conclusion

Maximizing growth through the combined power of virtual CFOs and cloud accounting services represents a strategic advantage for businesses aiming to thrive in competitive markets. Virtual CFOs offer vital financial leadership and strategic insights while cloud accounting ensures accurate, real-time financial data accessible to all stakeholders.

The synergy between these two elements drives improved cash flow management, faster reporting, reduced operational costs, and increased revenue growth. By implementing these solutions thoughtfully, companies not only enhance current performance but also position themselves for sustainable long-term success. Embracing this integrated approach empowers businesses to make data-driven decisions, respond swiftly to challenges, and capitalize on new growth opportunities with confidence.

Image by: Ivan Samkov

https://www.pexels.com/@ivan-samkov

editor's pick

latest video

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua