Navigating Nonemployee Compensation: A Comprehensive Guide for Freelancers and Independent Contractors

Nonemployee compensation refers to the income earned by individuals who are not considered employees of a company or organization. This includes freelancers, independent contractors, consultants, and other self-employed individuals who provide services to businesses on a contract basis. Nonemployee compensation can come in various forms, including fees for services, commissions, and bonuses. It is important for nonemployees to understand the nature of their compensation and how it differs from traditional employee wages.

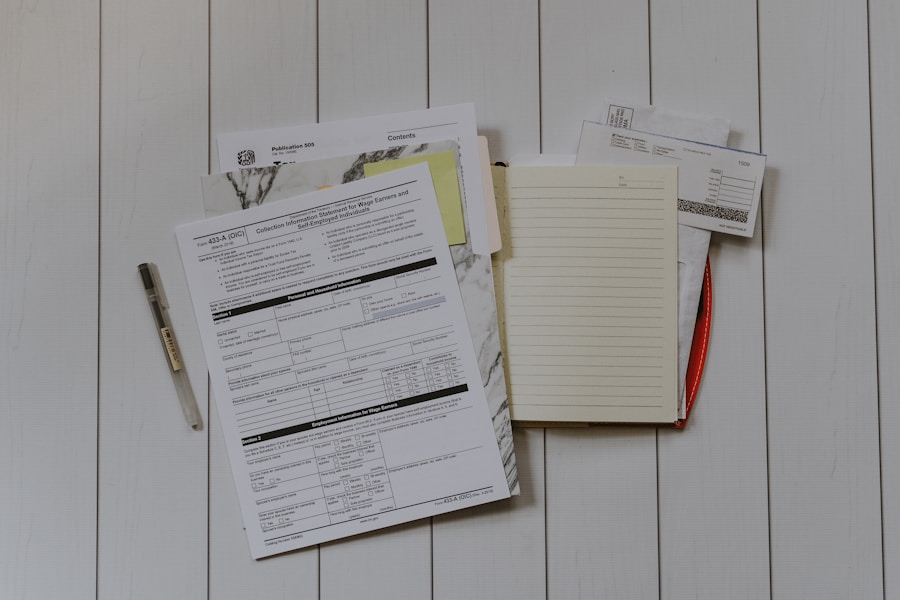

Nonemployee compensation is typically reported on Form 1099-MISC, which is issued by the payer to the recipient and the IRS. This form includes the total amount of compensation paid to the nonemployee during the tax year. It is important for nonemployees to keep accurate records of their income and expenses throughout the year in order to accurately report their earnings and deductions come tax time. Understanding nonemployee compensation is crucial for individuals who work independently, as it can impact their tax obligations, financial planning, and legal considerations.

Nonemployee compensation can be a complex topic, especially for those who are new to working as freelancers or independent contractors. It is important for nonemployees to educate themselves on the various aspects of their compensation, including how it is reported and taxed, in order to effectively manage their finances and ensure compliance with IRS regulations.

Tax Implications for Freelancers and Independent Contractors

Freelancers and independent contractors face unique tax implications compared to traditional employees. Nonemployee compensation is typically subject to self-employment tax, which covers Social Security and Medicare taxes for individuals who work for themselves. This means that nonemployees are responsible for paying both the employer and employee portions of these taxes, which can significantly impact their overall tax liability.

In addition to self-employment tax, nonemployee compensation is also subject to federal income tax and, in some cases, state and local taxes. It is important for freelancers and independent contractors to understand their tax obligations and make estimated tax payments throughout the year to avoid penalties and interest. Keeping accurate records of income and expenses is crucial for nonemployees to accurately report their earnings and take advantage of any available deductions and credits.

Navigating the tax implications of nonemployee compensation can be challenging, especially for those who are new to working independently. Seeking the guidance of a qualified tax professional can help nonemployees understand their tax obligations and develop a strategy for managing their tax liability. By staying informed and proactive about their tax responsibilities, freelancers and independent contractors can avoid costly mistakes and ensure compliance with IRS regulations.

Negotiating Fair Compensation as a Nonemployee

Negotiating fair compensation as a nonemployee can be a challenging but essential aspect of working independently. Unlike traditional employees who may have set salaries or hourly wages, nonemployees often have the opportunity to negotiate their rates with clients or employers. This can be both empowering and daunting, as it requires nonemployees to advocate for their worth while also considering market rates and industry standards.

When negotiating compensation as a nonemployee, it is important to research comparable rates for similar services in the industry. This can provide nonemployees with valuable insight into what is considered fair compensation for their work. Additionally, nonemployees should consider their level of experience, expertise, and the value they bring to the table when determining their rates. It is important for nonemployees to be confident in their abilities and communicate their value effectively during negotiations.

Negotiating fair compensation as a nonemployee also involves setting clear expectations with clients or employers regarding payment terms, deliverables, and project scope. Nonemployees should be prepared to discuss these details openly and honestly in order to establish a mutually beneficial agreement. By approaching negotiations with professionalism and confidence, nonemployees can secure fair compensation for their services while building strong working relationships with clients or employers.

Managing Finances as a Nonemployee

Managing finances as a nonemployee requires careful planning and organization in order to maintain financial stability and success. Unlike traditional employees who may have taxes withheld from their paychecks, nonemployees are responsible for managing their own taxes, budgeting for irregular income, and planning for retirement without the assistance of an employer-sponsored plan. This requires nonemployees to be proactive and disciplined in their financial management.

One key aspect of managing finances as a nonemployee is budgeting for irregular income. Nonemployees often experience fluctuations in their earnings due to the nature of contract work, which can make it challenging to predict cash flow. Creating a detailed budget that accounts for both fixed expenses and variable income can help nonemployees navigate these fluctuations and ensure they have enough funds to cover their financial obligations.

In addition to budgeting, nonemployees must also prioritize saving for taxes and retirement. Setting aside a portion of each payment for taxes can help nonemployees avoid a large tax bill at the end of the year. Similarly, contributing to retirement accounts such as IRAs or solo 401(k) plans can help nonemployees build long-term financial security. By making these financial priorities a regular part of their routine, nonemployees can effectively manage their finances and plan for the future.

Legal Considerations for Nonemployee Compensation

Nonemployee compensation comes with various legal considerations that freelancers and independent contractors must navigate in order to protect their rights and interests. Unlike traditional employees who are covered by labor laws and employment regulations, nonemployees often operate under contracts that outline the terms of their engagement with clients or employers. Understanding these legal considerations is crucial for nonemployees to ensure they are treated fairly and have recourse in the event of disputes or issues.

One important legal consideration for nonemployee compensation is the terms of the contract or agreement between the nonemployee and the payer. This document should clearly outline the scope of work, payment terms, deliverables, deadlines, and any other relevant details related to the engagement. Nonemployees should carefully review these contracts before signing to ensure they understand their rights and responsibilities.

Another legal consideration for nonemployee compensation is intellectual property rights. Nonemployees should be aware of how their work product will be used by the payer and whether they retain any rights to their creations. It is important for nonemployees to protect their intellectual property through clear agreements that outline ownership rights and usage permissions.

Benefits and Retirement Planning for Nonemployees

Nonemployees face unique challenges when it comes to benefits and retirement planning compared to traditional employees. While employees may have access to employer-sponsored health insurance, retirement plans, and other benefits, nonemployees are responsible for securing these benefits on their own. This requires careful planning and consideration in order to ensure nonemployees have access to essential benefits and are able to save for retirement.

One key benefit that nonemployees must consider is health insurance. Without access to employer-sponsored coverage, nonemployees must navigate the individual health insurance market in order to find a plan that meets their needs and budget. This may involve researching different plans, comparing costs and coverage options, and understanding enrollment periods in order to secure health insurance coverage.

In addition to health insurance, nonemployees must also prioritize retirement planning in order to build long-term financial security. While traditional employees may have access to employer-sponsored retirement plans such as 401(k)s, nonemployees can still save for retirement through individual retirement accounts (IRAs) or solo 401(k) plans. Contributing regularly to these accounts can help nonemployees build a nest egg for retirement and take advantage of tax-advantaged savings opportunities.

Resources for Nonemployees: Tools and Support for Success

Nonemployees have access to a variety of resources that can support their success in managing their careers, finances, and legal considerations. From professional organizations to online tools and support networks, there are numerous resources available to help freelancers and independent contractors navigate the challenges of working independently.

One valuable resource for nonemployees is professional organizations that cater to specific industries or professions. These organizations often provide networking opportunities, educational resources, advocacy support, and other benefits that can help nonemployees advance their careers and stay informed about industry trends.

In addition to professional organizations, there are also numerous online tools and platforms designed specifically for freelancers and independent contractors. These tools can help nonemployees manage their finances, track expenses, create invoices, and even find new clients or job opportunities. By leveraging these resources, nonemployees can streamline their operations and focus on growing their businesses.

Finally, support networks such as mentorship programs or peer groups can provide valuable emotional support and guidance for nonemployees navigating the challenges of working independently. These networks offer opportunities for collaboration, feedback, and camaraderie that can help nonemployees feel connected and supported in their professional endeavors.

In conclusion, understanding nonemployee compensation is crucial for individuals who work independently in order to effectively manage their finances, navigate legal considerations, plan for retirement, negotiate fair compensation, and access valuable resources that support success in their careers. By staying informed about these various aspects of nonemployee compensation, freelancers and independent contractors can build thriving businesses while maintaining financial stability and compliance with IRS regulations.